Waterproofing Chemicals Market Size | Companies Analysis 2025- 2034

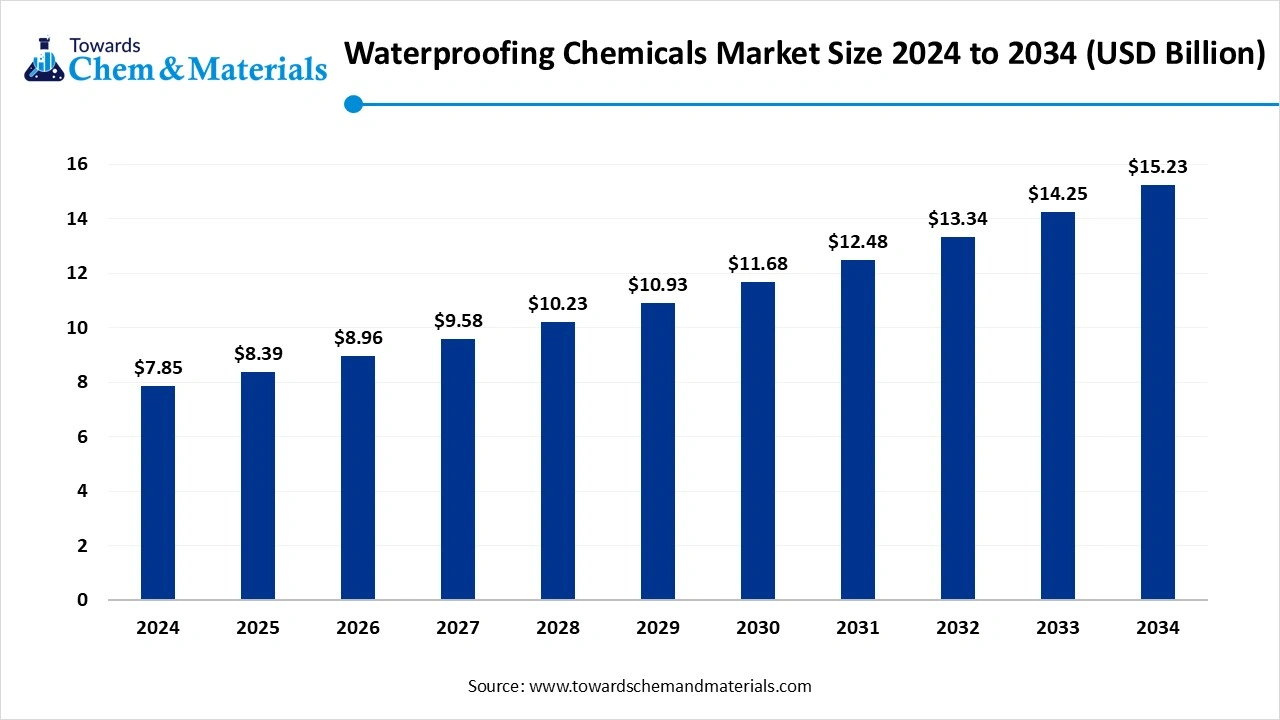

According to Towards Chemical and Materials, the global waterproofing chemicals market size is calculated at USD 8.39 billion in 2025 and is expected to be worth around USD 15.23 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.85% over the forecast period 2025 to 2034. The Key companies profiled are Pidilite Industries Ltd.; MAPEI S.p.A.; BASF SE; Sika AG; Dow; Carlisle Companies Inc.; DuPont; Mitsubishi Chemical Group Corporation; Evonik Industries AG; Bostik; Wacker Chemie AG

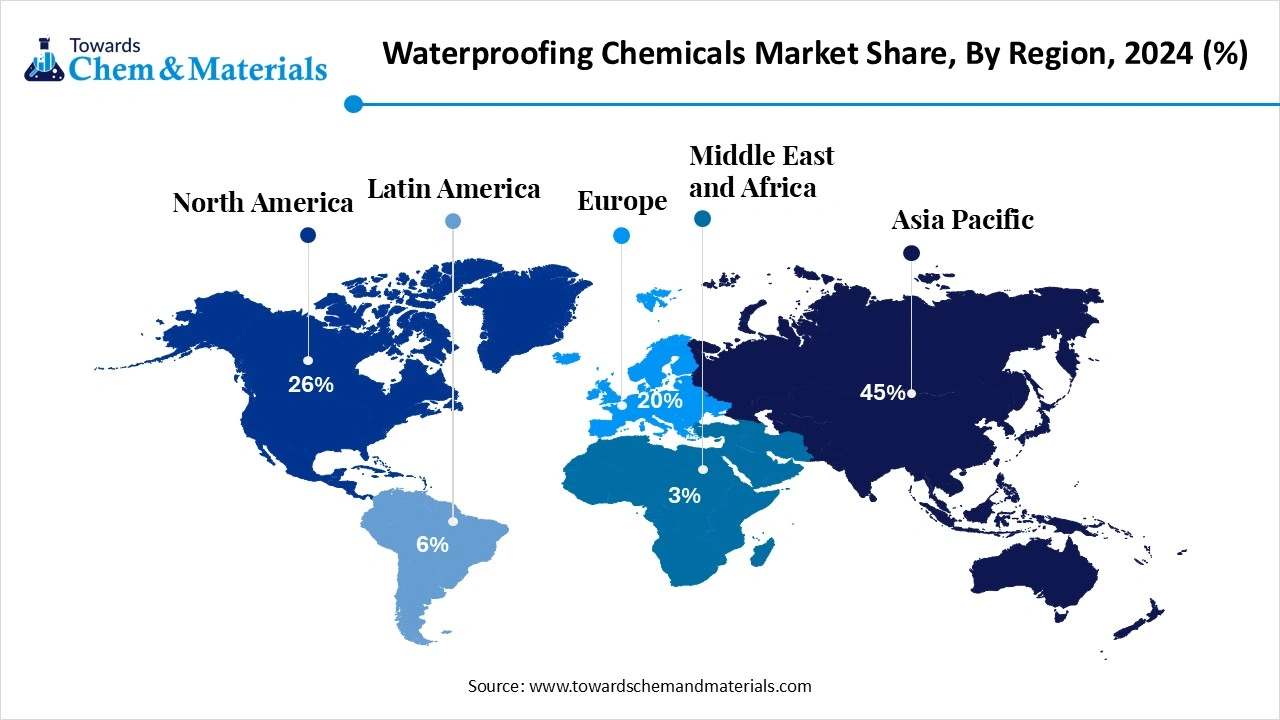

Ottawa, Nov. 03, 2025 (GLOBE NEWSWIRE) -- The global waterproofing chemicals market size was valued at USD 7.85 billion in 2024 and is anticipated to reach around USD 15.23 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.85% over the forecast period from 2025 to 2034. Asia Pacific dominated the waterproofing chemicals market with a market share of 45% in 2024. Rising demand for lactic acid in biodegradable plastics and sustainable packaging solutions is driving the growth of the global market. A study published by Towards Chemical and Materials a sister firm of Precedence Research.

Download a Sample Report Here@ https://www.towardschemandmaterials.com/download-sample/5895

What are Waterproofing Chemicals?

The waterproofing chemicals market plays a pivotal role in protecting buildings and infrastructure from water ingress, leakage, and corrosion, thereby enhancing structural durability, safety, and lifespan. The market is being propelled by rapid urbanisation, increasing infrastructure investment, and the growing need for climate-resilient and long-living construction assets that demand effective moisture barriers and crack-bridging solutions. Key product developments include eco-friendly, low-VOC, and solvent-free formulations as well as technologically advanced membranes incorporating self-healing, Nano-reinforced, and polymer-modified chemistries.

Geographically, demand is concentrated in regions with intensive construction activity, especially in the Asia Pacific, supported by government initiatives and large-scale public works. Distribution and market access are evolving with direct project sales and increasing online/e-commerce channels, while applications span from roofing, balconies, and podium decks to commercial building, infrastructure, and public works.

Waterproofing Chemicals Market Report Highlights

- The Asia Pacific waterproofing chemicals market held the largest share of 45% of the global market in 2024.

- By product type, the liquid-applied membranes–single components segment held the highest market share of 35% in 2024.

- By application area, the roofing segment held the highest market share of 22% in 2024.

- By end-use sector, the commercial buildings segment held the largest revenue share of 32% in 2024.

- By distribution channel, the direct project sales segment held the largest market share of 42% in 2024.

- By performance requirement, the high-flexibility/crack-bridging segment dominated the market with a share of 30% in 2024

Invest in Premium Global Insights Immediate Delivery Available (Global Deep Dive USD 3900) https://www.towardschemandmaterials.com/checkout/5895

Waterproofing Chemicals Market Report Scope

| Report Attribute | Details |

| Market size value in 2026 | USD 8.95 billion |

| Revenue Forecast in 2034 | USD 15.23 billion |

| Growth Rate | CAGR of 6.85% from 2025 to 2034 |

| Base year for estimation | 2024 |

| Historical data | 2020 - 2024 |

| Forecast period | 2024 - 2034 |

| Quantitative units | Revenue in USD billion/million, volume in kilotons, and CAGR from 2024 to 2030 |

| Segments Covered | By Product Type, By Application Area, By End-use Sector, By Distribution Channel, By Performance Requirement, By Region |

| Regional scope | North America, Europe, Asia Pacific, Latin America, MEA |

| Key companies profiled | Pidilite Industries Ltd.; MAPEI S.p.A.; BASF SE; Sika AG; Dow; Carlisle Companies Inc.; DuPont; Mitsubishi Chemical Group Corporation; Evonik Industries AG; Bostik; Wacker Chemie AG |

For more information, visit the Towards Chemical and Materials website or email the team at sales@towardschemandmaterials.com| +1 804 441 9344

Types of Waterproof Chemicals for Beginners

If you’re new to waterproofing, you’ll find that the wide array of products can be daunting. So don’t worry, here’s a beginner’s guide to the most common types of waterproof chemicals and the purposes they serve.

1. Liquid Waterproofing Membranes

Best suited for: Bathrooms, balconies, terraces, rooftops

Liquid waterproofing membranes are put on like paint with a roller, brush, or spray. Once dry, it becomes an easy-going, rubbery film that sheds water. It is often flexible, meaning it can move mildly with the surface without cracking.

Pros:

- Easy to apply

- Ideal for uneven surfaces

- Seamless protection

2. Crystalline Waterproofing Compounds

Best suited for: Basements, water tanks, concrete walls

Crystalline waterproofing chemicals react with moisture in concrete to produce crystals that block pathways of water. It is typically mixed with cement or applied as a coating.

Pros:

- Longevity

- Penetrates deep through concrete

- Ideal for internal waterproofing

3. Bituminous Coatings

Best suited for: Roofs, foundations, waterproofing under tiles

Also known as asphalt coatings, these sticky black materials provide a thick, protective layer. Some are modified with polymers, which improve flexibility.

Pros:

- Affordable

- Tough and durable

- Weather-resistant

4. Polyurethane-Based Waterproofing

Best for: Rooftops, decks, balconies, terraces

This waterproof chemical has an elastic membrane that is resistant to weather and UV rays. It works especially well for areas that will expand and contract in heat.

Advantages:

- Great flexibility

- UV resistant

- Works in exposed locations

5. Silicone and acrylic sealants

Best for: joints, windows, doors, tiles

These are used for small, specific areas that need to be sealed. They can be used to fill gaps or cracks in walls, bathroom fixtures, and in the frames of windows.

Advantages:

- Simple application

- Works in tight spots

- Prevents leaks and drafts

Which are the Major Sustainability Trends in the Waterproofing Chemicals Industry?

- Eco-friendly and low-VOC products: The industry is developing water-based, non-toxic, and low-VOC (volatile organic compound) alternatives to reduce environmental harm and improve indoor air quality.

- Energy-efficient cool roof coatings: Manufacturers are creating coatings with high solar reflectance to reduce a building's heat absorption, thereby decreasing energy consumption for cooling.

- Technological innovation with advanced materials: Advances include using nanotechnology for ultra-thin and long-lasting protection and developing "self-healing" materials that repair minor damage to extend a product's lifespan.

- Circular economy and waste reduction: The industry is increasingly adopting circular practices by using recycled materials, such as rubber and plastic, and designing products for durability to reduce waste.

What Are the Major Trends in the Waterproofing Chemicals Market?

- Growing focus on eco-friendly and sustainable formulations, with an increasing adoption of low-VOC, solvent-free free and waste-based waterproofing solutions.

- Rising implementation of advanced material technologies, including nanotechnology, self-healing membranes, and hybrid polymer systems, to enhance durability and performance.

- Expansion of large-scale infrastructure, urbanization, and public works projects in emerging economies is driving demand for high-performance waterproofing chemicals.

- Shift in distribution and market access channels, with increasing importance of online/ e-commerce platforms for smaller projects, alongside direct project sales for large contracts.

How Does AI Influence the Growth of the Waterproofing Chemicals Market In 2025?

In 2025, the influence of artificial intelligence (AI) on the market is unfolding in several meaningful ways. AI-driven analytics are enabling chemical manufacturers to refine formulations more efficiently by predicting how different raw materials, polymer blends, and process conditions will perform under varied environmental stresses, thus accelerating product development and enhancing performance reliability.

Concurrently, AI-enhanced production systems and automation at manufacturing sites are boosting operational efficiency, reducing variability and waste, and improving consistency of high-performance waterproofing agents. Further AI-powered supply chain optimisation is helping firms better anticipate demand, manage inventory, align logistics, and ensure the timely delivery of waterproofing solutions to large-scale construction projects, which supports market expansion.

Immediate Delivery Available | Buy This Premium Research Report (Global Deep Dive USD 3900) https://www.towardschemandmaterials.com/checkout/5895

Waterproofing Chemicals Market Dynamics

Growth Factors

-

Why Is Rapid Construction Demand?

The expansion of building and infrastructure activity around the world means more structures are exposed to moisture and water ingress risks, which boosts demand for waterproofing chemicals that improve durability and protect against leakage. This surge in construction is creating a stronger requirement for sealing, lining, and protective systems in both new and renovation projects.

-

How Is Climate Change Influencing Waterproofing Needs?

As extreme weather events become more frequent and unpredictable, the need for robust waterproofing solutions increases because traditional systems are no longer sufficient to handle more intense rainfall, flooding, and freeze-thaw cycles. This drives the adoption of advanced waterproofing materials that can resist harsher environments and thus expands the market for such chemicals.

Market Opportunity

Why Is Rapid Construction Driving Demand?

The expansion of building and infrastructure activity around the world means more structures are exposed to moisture and water ingress risks, which boosts demand for waterproofing chemicals that improve durability and protect against leakage. This surge in construction is creating a stronger requirement for sealing, lining, and protective systems in both new and renovation projects.

How is Climate Change Influencing Waterproofing Needs?

As extreme weather events become more frequent and unpredictable, the need for robust waterproofing solutions increases because traditional systems are no longer sufficient to handle more intense rainfall, flooding, and freeze thaw cycles. This drives the adoption of advanced waterproofing materials that can resist harsher environments and thus expands the market for such chemicals.

Limitations & Challenges

- The volatility in raw material costs and supply chain disruptions, which drives up production costs and limits adoption of avdnced waterproofing solutions.

- The requirement for skilled labour and proper application workflows, where inadequate workmanship or importer installation can diminish performance and reduce buyer confidence.

Waterproofing Chemicals Market Segmentation Insights

Product Type Insights:

Which Product Type Dominates the Waterproofing Chemicals Market?

The liquid-applied membranes single-component segment dominated the market. This category has become the preferred choice in construction due to its easy application, strong adhesion properties, and consistent performance across various surfaces. Builders and contractors favour single component membranes for both small scale and large infrastructure projects as they reduce mixing errors and application time while ensuring uniform waterproof protection. Their versatility across roofing, basements, and exterior surfaces strengthens their demand. The increasing awareness of moisture protection, coupled with government-backed initiatives in infrastructure development, continues to drive the adoption of single-component waterproofing systems in multiple sectors.

The liquid-applied membranes two-component segment is growing at the fastest rate in the market. This growth is largely attributed to its superior performance in high-stress environments and its ability to provide strong chemical and mechanical resistance. The segment’s development is further supported by increasing use in commercial and industrial structures where extreme durability and flexibility are critical. As construction standards evolve onward higher longevity and environmental resistance, two component membranes are gaining preference for complex architectural and infrastructural applications.

Application Area Insights:

Which Application Area Dominates the Waterproofing Chemicals Market?

The roofing segment dominated the market. Roofing is one of the most critical components requiring waterproofing to prevent structural damage, leakage, and energy loss. The demand for high-quality roofing membranes is being propelled by rapid urban development, increasing commercial construction, and the modernization of gaining structures. Builders prefer advanced waterproofing chemicals that provide seamless coating, UV resistance, and long-lasting protection against environmental degradation. As cities expand and architectural designs evolve, the roofing segment continues to be at the forefront of waterproofing innovations, with sustainability and durability remaining top priorities.

The balconies and podium decks segment is growing at the fastest rate in the coming years. This growth stems from the increasing emphasis on premium housing, mixed-use buildings, and outdoor recreational spaces that require effective waterproofing solutions. Balconies and podium decks are highly exposed to water penetration and thermal movement, making them areas of concern in both new constructions and refurbishments. The adoption of advanced waterproofing technologies for these areas is supported by rising design complexity, growing consumer expectations for durability, and the need for aesthetic preservation.

End Use Insights:

Which End Use Segment Dominates the Waterproofing Chemicals Market?

The commercial buildings segment captured a major portion of the market. Rapid urbanization, expansion of commercial real estate, and large-scale construction of offices, malls and hospitality complexes have all increased the need for efficient waterproofing systems. Commercial projects often require superior chemical protection and flexibility, especially for roofs, basements, and water tanks exposed to heavy use and variable climates. The growing emphasis on sustainable construction materials and longer structural life further drives the preference for advanced waterproofing chemicals. This segment continues to grow as cities modernize and demand for durable, leak free commercial spaces expands.

The infrastructure and public works segment is growing the fastest in the market. Expanding investments in transportation networks, bridges, tunnels, and water management systems have accelerated the need for high-performance waterproofing chemicals capable of withstanding extreme conditions. Governments are focusing on upgrading existing infrastructure while ensuring sustainability and resilience against weather impacts, boosting the adoption of waterproofing solutions. The segment benefits from a combination of technological advancements and policy-driven development goals aimed at improving structural longevity. As nations prioritize durable public infrastructure, this segment is expected to remain a key growth driver in the market.

Distribution Channel Insights:

Which Distribution Channel Dominates in the Waterproofing Chemicals Market?

The direct project sales segment dominated the market. Direct sales remain the most the most effective mode of distribution for large construction projects, ensuring customized supply, technical assistance, and quality control. Manufacturers and contractors often engage in direct procurement to streamline logistics, reduce costs, and maintain consistency across large developments. The increasing number of infrastructure and commercial projects has further strengthened the demand for this channel. Direct sales also facilitate stronger relationships between manufacturers and end users, allowing for tailored waterproofing solutions aligned with project specific requirements.

The online / e-commerce segment is expanding rapidly in the market. Digitalization and the growing preference for convenient purchasing options have transformed how waterproofing chemicals are marketed and distributed. Smaller contractors, DIY builders, and local dealers increasingly rely on online platforms for quick access to materials, product comparisons, and transparent pricing. The availability of product information, technical support, and customer reviews enhances buyer confidence and accelerates adoption. As the construction industry embraces digital tools, online distribution is expected to gain even greater traction, providing flexibility and accessibility across diverse user groups.

Performance Requirement Insights:

Which Performance Requirement Dominates in the Waterproofing Chemicals Market?

The high/flexibility/ crack bridging segment dominated the market. These products are designed to withstand structural movement, vibration, and thermal expansion without compromising integrity, making them ideal for both residential and commercial applications. Their superior elasticity ensures consistent waterproofing performance even under shifting load conditions and environmental stress. The demand for such solutions has surged as builders increasingly prioritize longevity and resilience in construction materials. Moreover, the combination of flexibility and adhesion strength makes these chemicals vital for applications like roofs, terraces, and basements, where expansion and contraction are frequent.

The fast-curing/rapid return to service segment is witnessing the fastest growth. The rising need for time efficient construction and quick project completion has driven the adoption of fast curing waterproofing systems. These materials allow for faster installation and reduced downtime, making them ideal for repair, maintenance, and emergency waterproofing applications. As infrastructure and industrial projects operate under tighter schedules, contractors increasingly rely on these high-performance solutions. Their efficiency, coupled with reliable long-term protection, positions them as an essential component in modern construction practices focused on speed and sustainability.

Regional Insights

Why is the Asia Pacific Region Dominating the Waterproofing Chemicals Market?

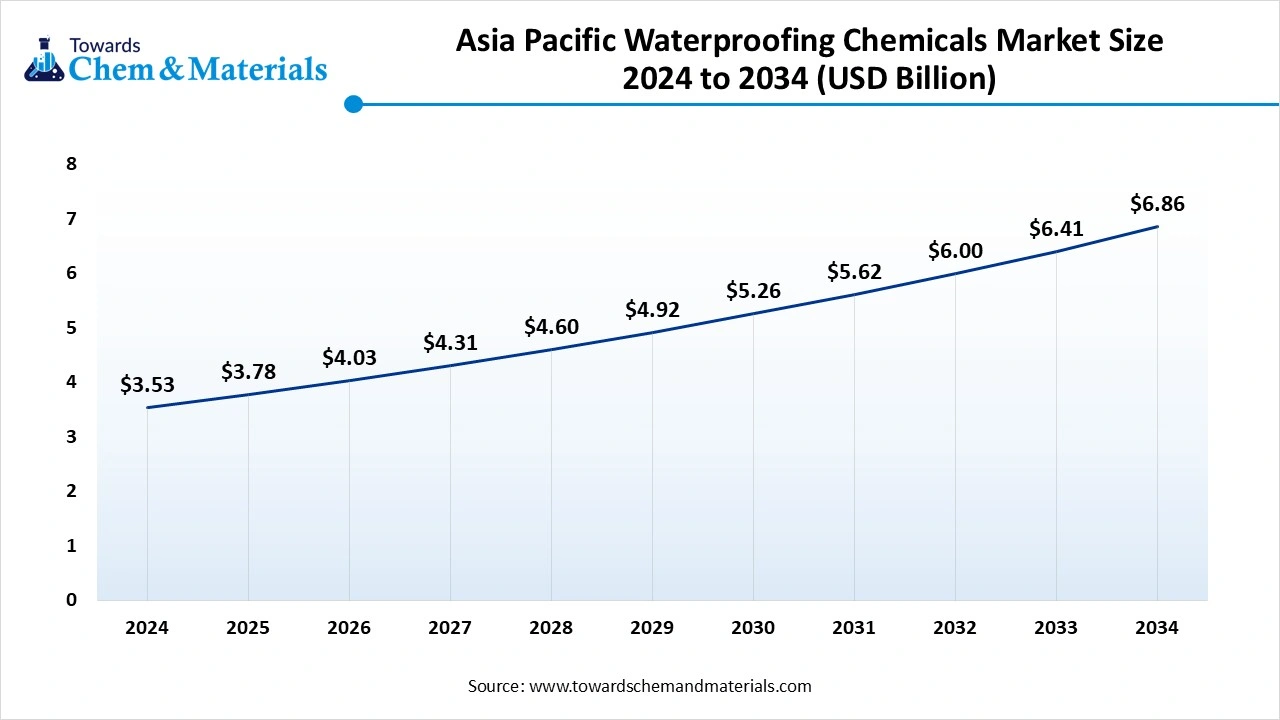

The Asia Pacific waterproofing chemicals market size was valued at USD 3.53 billion in 2024 and is expected to surpass around USD 6.86 billion by 2034, expanding at a compound annual growth rate (CAGR) of 6.87% over the forecast period from 2025 to 2034. Asia Pacific dominated the waterproofing chemicals market share of 45% in 2024.

Asia Pacific dominates the market in 2024, due to escalating construction and infrastructure development driven by rapid urbanisation and government backed investment in residential as well as public works projects. The region’s strong manufacturing base for specialty chemicals and construction materials enhances cost-efficiency and supply chain responsiveness for waterproofing products. Rising awareness of building durability and climate resilience in the region further supports the adoption of advanced waterproofing chemistries. Given its large population, expanding middle class, and increasing commercial construction demand, the region maintains its dominant position in the market.

India Waterproofing Chemicals Market Trends

Within the Asia Pacific, India stands out as a key driver for the market thanks to robust growth in its construction sector, marked by housing, commercial buildings, and infrastructure projects. The presence of prominent chemical manufacturers and waterproofing solution providers in India enhances market maturity and accessibility, enabling faster uptake of high-performance waterproofing systems. Government urbanisation initiatives, along with rising demand for retrofit and new build waterproofing, create strong local demand.

How is North America Expanding its Waterproofing Chemicals Industry?

North America is projected to grow at the highest rate for the market as the construction and infrastructure sectors pivot toward higher performance standards, retrofit of aging structures, and adoption of sustainable building practices. Innovation in waterproofing materials and rising demand for products that comply with stricter regulatory and environmental requirements boost the uptake of advanced solutions across the region. Market participants are increasingly investing in upgraded formulations and system integration services tailored for North American building codes and climate-resilient water ingress risks, and the shift toward premium waterproofing systems positions the region for accelerated growth.

U.S. Waterproofing Chemicals Market Analysis

The U.S. dominates the regional due to its extensive construction and infrastructure development activities, particularly in residential, commercial, and industrial sectors. The country's stringent building codes and sustainability standards drive the use of advanced waterproofing solutions to enhance building longevity and energy efficiency. Moreover, the presence of major manufacturers such as BASF SE, Sika AG, and Dow Inc. Supports continuous innovation and product availability across regions.

Europe Waterproofing Chemicals Market Trends

In 2024, Europe captured a significant share of the global waterproofing chemicals market. The growing emphasis on restoring and maintaining aging infrastructure—such as bridges, tunnels, and dams—has fueled the demand for advanced waterproofing solutions to enhance structural longevity and integrity. Moreover, the region’s abundance of historical monuments, which require regular preservation, has further contributed to the market’s expansion. The surge in new construction projects across urban centers also continues to drive the need for high-performance waterproofing materials throughout Europe.

The United Kingdom emerged as a key contributor to the regional market in 2024. Strict regulatory standards governing residential and commercial construction have compelled developers to integrate waterproofing systems into building practices. Additionally, the country’s consistently high levels of rainfall and unpredictable weather patterns have accelerated the adoption of innovative waterproofing chemicals designed to withstand harsh climatic conditions and ensure long-term durability.

Top Companies in the Waterproofing Chemicals Market

Tier 1 Companies:

- RPM International (Tremco, Carboline) - Offers a wide range of waterproofing chemicals, including high-performance coatings, sealants, and membranes, through its subsidiaries like Tremco for the building envelope and Carboline for industrial corrosion control.

- Pidilite Industries - Provides a comprehensive suite of waterproofing products, most notably under its Dr. Fixit brand, which includes solutions for terraces, bathrooms, and concrete structures.

- Asian Paints - Sells waterproofing solutions through its SmartCare product line, which features protective and decorative coatings for terraces and exterior walls that offer benefits like crack-bridging and temperature reduction.

- Jotun - Supplies high-performance waterproofing exterior paints, such as Jotashield WaterXtreme, designed to protect buildings from rain with features like crack-bridging, UV resistance, and heat reduction.

- Saint-Gobain Weber - Offers a diverse portfolio of waterproofing systems, including acrylic and cementitious membranes, under its weberdry line for applications like roofs, wet areas, and exterior walls.

- Ardex - Manufactures advanced waterproofing membranes and compounds, such as the WPM series, for commercial and residential applications, often used in conjunction with tile and flooring systems.

-

Carlisle Companies - Provides a complete line of high-performance waterproofing systems, including sheet-applied and liquid-applied membranes, for the building envelope through its subsidiary Carlisle Weatherproofing Technologies (CWT).

More Insights in Towards Chemical and Materials:

- AI in Chemicals Market : The global artificial intelligence in chemical market size accounted for USD 2.19 billion in 2024, grew to USD 2.83 billion in 2025, and is expected to be worth around USD 28.74 billion by 2034, poised to grow at a CAGR of 29.36% between 2025 and 2034.

- Construction Chemicals Market : The global construction chemicals market size is calculated at USD 51.19 billion in 2024, grew to USD 53.02 billion in 2025 and is predicted to hit around USD 72.7 billion by 2034, expanding at healthy CAGR of 3.57% between 2025 and 2034.

- Chemical Distribution Market : The global chemical distribution market volume was reached at 239.32 million tons in 2024 and is expected to be worth around 440.18 million tons by 2034, exhibiting at a compound annual growth rate (CAGR) of 6.28% over the forecast period 2025 to 2034.

- Green Chemicals Market : The global green chemicals market size was estimated at USD 14.94 billion in 2025 and is predicted to increase from USD 16.11 billion in 2026 to approximately USD 29.49 billion by 2034, expanding at a CAGR of 7.85% from 2025 to 2034.

- Crop Protection Chemicals Market : The global crop protection chemicals market size accounted for USD 79.44 billion in 2024 and is predicted to increase from USD 83.95 billion in 2025 to approximately USD 138.03 billion by 2034, expanding at a CAGR of 5.68% from 2025 to 2034.

- Agrochemicals Market : The global agrochemicals market size accounted for USD 285.36 billion in 2024 and is predicted to increase from USD 300.91 billion in 2025 to approximately USD 485.13 billion by 2034, expanding at a CAGR of 5.45% from 2025 to 2034.

- Water Treatment Chemicals Market : The global water treatment chemicals market size was reached at USD 38.88 billion in 2024 and is expected to be worth around USD 58.16 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.11% over the forecast period 2025 to 2034.

- Water and Wastewater Treatment Market : The global water & wastewater treatment market size was approximately USD 371.00 billion in 2025 and is projected to reach around USD 656.68 billion by 2034, with an estimated compound annual growth rate (CAGR) of about 6.55% between 2025 and 2034.

- Commodity Chemicals Market : The global commodity chemicals market size was valued at USD 813.85 billion in 2024, grew to USD 867.97 billion in 2025, and is expected to hit around USD 1,549.36 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.65% over the forecast period from 2025 to 2034.

- Flame Retardant Chemicals Market : The global flame retardant chemicals market size was estimated at USD 7.85 billion in 2024 and is expected to hit around USD 13.60 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.65% over the forecast period from 2025 to 2034.

- Textile Chemicals Market : The global textile chemicals market volume is expected to produce approximately 1.52 million tons in 2025, with a forecasted increase to 2.46 million tons by 2034, growing at a CAGR of 5.49% from 2025 to 2034.

- Electronic Materials And Chemicals Market : The global electronic materials and chemicals market size was valued at USD 74.19 billion in 2024 and is expected to hit around USD 136.03 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.25% over the forecast period from 2025 to 2034.

- Froth Flotation Chemicals Market : The global froth flotation chemicals market size was reached at USD 2.11 billion in 2024, is grew to USD 2.20 billion in 2025 and is expected to be worth around USD 3.26 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.45% over the forecast period 2025 to 2034.

- Lithium Chemicals Market : The global lithium chemicals market size was reached at USD 33.19 billion in 2024 and is expected to be worth around USD 196.28 billion by 2034, growing at a compound annual growth rate (CAGR) of 50% over the forecast period 2025 to 2034.

- Sustainability Chemical Market : The global sustainability chemical market size was reached at USD 80.77 billion in 2024 and is expected to be worth around USD 161.73 billion by 2034, growing at a compound annual growth rate (CAGR) of 7.19% over the forecast period 2025 to 2034.

- Bio-Based Platform Chemicals Market : The global bio-based platform chemicals market size was reached at USD 29.33 billion in 2024 and is expected to be worth around USD 48.46 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.15% over the forecast period 2025 to 2034.

- Natural Aroma Chemicals Market : The global natural aroma chemicals market size was reached at USD 4.55 billion in 2024 and is estimated to surpass around USD 5.91 billion by 2034, growing at a compound annual growth rate (CAGR) of 2.65% during the forecast period 2025 to 2034.

- Specialty Chemicals Market : The global specialty chemicals market size is calculated at USD 671.19 billion in 2024, grew to USD 706.36 billion in 2025, and is projected to reach around USD 1,118.55 billion by 2034. The market is expanding at a CAGR of 5.24% between 2025 and 2034.

- Oleochemicals Market : The global oleochemicals market volume is calculated at 17.70 million tons in 2024, grew to 18.50 million tons in 2025, and is projected to reach around 27.50 million tons by 2034. The market is expanding at a CAGR of 4.50% between 2025 and 2034.

- Cosmetic Chemicals Market : The global cosmetic chemicals market size was estimated at USD 4.85 billion in 2024 and is expected to hit around USD 16.83 billion by 2034, growing at a compound annual growth rate (CAGR) of 13.25% over the forecast period from 2025 to 2034.

- GCC Specialty Chemicals Market : The global gcc specialty chemicals market size was valued at $ 36.89 billion in 2024 and is estimated to reach around USD 55.13 billion by 2034, exhibiting a compound annual growth rate (CAGR) of 4.10% during the forecast period 2025 to 2034.

- PFAS Free Chemicals Market : The global PFAS-free chemicals market volume is calculated at 211.23 kilotons in 2024, grows to 244.32 kilotons in 2025, and is projected to reach around 905.32 kilotons by 2034, growing at a CAGR of 15.67% from 2025 to 2034.

- U.S. Agrochemicals Market : The U.S. agrochemicals market size was valued at USD 35.19 billion in 2024 and is expected to hit around USD 42.69 billion by 2034, growing at a compound annual growth rate (CAGR) of 1.95% over the forecast period from 2025 to 2034.

- U.S. Froth Flotation Chemicals Market : The U.S. froth flotation chemicals market volume was reached at 81.12 kilo tons in 2024 and is expected to be worth around 115.21 kilo tons by 2034, growing at a compound annual growth rate (CAGR) of 3.57% over the forecast period 2025 to 2034.

- U.S. Water and Wastewater Treatment Market : The U.S. water and wastewater treatment market size accounted for USD 121.85 billion in 2024 and is predicted to increase from USD 130.31 billion in 2025 to approximately USD 238.36 billion by 2034, expanding at a CAGR of 6.94% from 2025 to 2034.

- Europe Specialty Chemicals Market : The Europe specialty chemicals market volume was reached at 91.51 million tons in 2024 and is expected to be worth around 125.43 million tons by 2034, growing at a compound annual growth rate (CAGR) of 3.20% over the forecast period 2025 to 2034.

-

Asia Pacific Specialty Chemicals Market : The Asia Pacific specialty chemicals market size was reached at USD 416.51 billion in 2024 and is expected to be worth around USD 594.95 billion by 2034, growing at a compound annual growth rate (CAGR) of 3.63% over the forecast period 2025 to 2034.

Waterproofing Chemicals Market Top Key Companies:

- RPM International (Tremco, Carboline)

- Pidilite Industries

- Asian Paints

- Jotun

- Saint-Gobain Weber

- Ardex

- Carlisle Companies

- Kryton International

- Soudal

- Wacker Chemie

- Kemper System

- Kerakoll

- H.B. Fuller

- Huntsman Corporation

- Soprema

Recent Developments

- In February 2025, the Swiss construction chemicals specialist Sika AG reported full-year results that surpassed expectations, citing strong performance in waterproofing and concrete protection applications despite challenging industry conditions. The company highlighted record sales and robust profitability as signs of resilience in the waterproofing segment.

- In May 2025, globally, the chemical industry is facing headwinds as BASF SE initiated the divestment of its coatings business and lowered its earnings outlook due to weaker demand and tariff pressures. These strategic moves signal a shifting dynamic that could impact upstream raw materials and waterproofing chemical supply chains.

Waterproofing Chemicals Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2034. For this study, Towards Chemical and Materials has segmented the global Waterproofing Chemicals Market

By Product Type

- Liquid-applied membranes single-component

- Liquid-applied membranes two-component

- Sheet membranes bituminous

- Sheet membranes synthetic

- Cementitious waterproofing

- Crystalline waterproofing admixtures

- Bituminous coatings & emulsions

- Injection chemicals & grouts

- Sealants & joint fillers

- Polymer

- PVC

- TPO

- EPDM

- Others

By Application Area

- Roofing

- Basements & substructures

- Wet areas

- Water tanks & reservoirs

- Tunnels & underground works

- Bridges & highways

- Marine & coastal structures

- Swimming pools & leisure facilities

- Balconies & podium decks

- Car parks & ramps

- Façade & external walls

- Industrial facilities

- Green roofs

By End-use Sector

- Residential

- Commercial buildings

- Institutional

- Industrial

- Infrastructure & public works

By Distribution Channel

- Direct project sales

- Distributors & wholesalers

- Retail

- Online / e-commerce

By Performance Requirement

- Potable-water safe systems

- Chemical/abrasion-resistant systems

- Fast-curing / rapid return-to-service systems

- High-flexibility / crack-bridging systems

- UV/weather-resistant systems

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Immediate Delivery Available | Buy This Premium Research Report (Global Deep Dive USD 3900) https://www.towardschemandmaterials.com/checkout/5895

About Us

Towards Chemical and Materials is a leading global consulting firm specializing in providing comprehensive and strategic research solutions across the chemical and materials industries. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations.

Our Trusted Data Partners

Towards chem and Material | Precedence Research | Statifacts | Towards Packaging | Towards Healthcare | Towards Food and Beverages | Towards Automotive | Towards Consumer Goods | Nova One Advisor | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

For Latest Update Follow Us: https://www.linkedin.com/company/towards-chem-and-materials/

USA: +1 804 441 9344

APAC: +61 485 981 310 or +91 87933 22019

Europe: +44 7383 092 044

Email: sales@towardschemandmaterials.com

Web: https://www.towardschemandmaterials.com/

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.